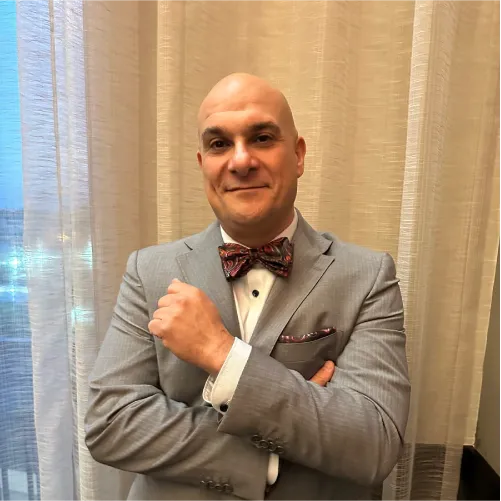

If you are an active investor, high-earner, or advisor who keeps writing painful tax checks, this episode shows you another way. The Bow Tie Attorney sits down with Nischay Rawal, CPA and Managing Partner at NCPAs, to walk through the legal and tax structures serious real estate players use to keep more of what they earn.

Most investors and high-income professionals treat taxes like cleanup: they run hard all year, then hand a shoebox of numbers to their CPA in March and hope the damage is not too bad. In this episode, we flip that script.

Attorney Mahmoud Faisal Elkhatib sits down with strategic tax advisor Nischay Rawal, CPA, to unpack how real estate can be used to legally drive your tax bill toward zero. They look at the full picture: entities, acquisitions, cash-flow design, cost segregation, capital gains planning, and documentation that actually survives an audit.

If you are an investor or high-net-worth individual, “year-end cleanup” is not a strategy — it is a leak. This episode shows you how to plug it.

Rather than chasing deductions at the end of the year, Mahmoud and Nisch walk through what it looks like to architect your tax position on purpose. They explain how legal structure, timing, and the right kind of paperwork can turn the same income into a radically different after-tax result.

The goal is not to play cute games with the IRS. The goal is to understand the rules deeply enough that you can align your deals, your entities, and your calendar with them — and keep more of what your portfolio already earns.

If your tax bill keeps climbing while your portfolio works harder, it is time to change the structure, not just chase more write-offs.

This conversation is built for people who want results, not theory. In plain English, Mahmoud and Nisch break down how legal structure and tax strategy fit together so that your money moves cleanly through your system and lands where you want it — not in an unexpected tax bill.

You will hear how “tax repairs” are less about last-minute write-offs and more about fixing the chassis of your business: entity wiring, money flow, and documentation. When that foundation is right, you can defend your position and keep your cash working inside your portfolio instead of bleeding out every April.

Instead of asking “What can we write off this year?”, Mahmoud and Nisch ask a better question: “How should the entire year be designed so that the right numbers land on the return automatically?” That shift from compliance to architecture is where seven-figure savings accumulate over time.

Most investors treat taxes like cleanup. This episode shows you how to design the calendar like an engineer so the math works before the year even starts.

This episode is not just for accountants. It is built for the people who actually sign contracts, write checks, and feel the tax hits in real time. If you touch real estate money in any serious way, you will recognize yourself in this conversation.

If you are responsible for deals, cash flow, or strategy — not just compliance — this episode will give you language and frameworks you can take straight to your CPA and attorney.

Mahmoud and Nisch walk through real-world scenarios, not hypotheticals. You will see how entity charts, inter-company agreements, and documentation habits either protect or destroy ROI — and how to start tightening things up even if your current setup is messy.

By the end, you will know which questions to ask, what red flags to look for, and where the line sits between a smart, aggressive position and something that will fall apart under scrutiny.

Share your situation with EV Häs, LLC and get a legal game plan you can align with your CPA and investment team.

Talking about tax is one thing. Seeing how the money actually moves is another. In this episode, Mahmoud and Nisch pull back the curtain on the diagrams and documents that sit behind a properly engineered real estate tax plan.

They walk through how entities connect, where cash enters and exits, and how specific elections and schedules support the story your return is telling. The goal is to give you a mental “map” so that your next deal fits into a larger design instead of living on its own island.

Think entity diagrams, inter-company cash-flow maps, depreciation schedules, Opportunity Zone frameworks, and live Q&A around the pressure points that matter most.

The current market is noisy. Policies are shifting, underwriters are more cautious, and audits are getting sharper. In that kind of environment, treating taxes as an afterthought quietly kills ROI and creates unnecessary stress. This episode is designed to close the gap between black-letter law and day-to-day deal work.

You will hear how to build a repeatable, defensible planning process that your CPA and attorney can both support. The aim is not to turn you into a tax professional, but to give you enough substance to ask better questions, push for better structures, and recognize when something you are being offered is just “decorative strategy.”

Information without implementation is just stress. Mahmoud and Nisch close the episode with a 90-day blueprint so you can turn ideas into action. The plan is simple on purpose: audit what you have, integrate what you are missing, and then lock it into a repeatable calendar.

In 90 days, the goal is to move from scattered files and vague strategies to a clear, audit-ready system that keeps more money working inside your real estate portfolio.

Days 1–30: Foundation building. During the first month, you audit your current structure and gather the paperwork that already exists.

Days 31–60: Integration, and Days 61–90: Optimization. Once the basics are clear, you begin weaving structure into every deal and then scaling what works.

Missed payments, tax liens, or aggressive collection letters are early warning signs, not the end of the story.

These answers are general education, not legal or tax advice for your specific situation. Real estate strategy always depends on your facts, your risk tolerance, and the professionals on your team. Talk with a qualified CPA and attorney before you implement any approach discussed in this episode.

In some years, yes — but only under very specific circumstances and always within the rules. Real estate offers powerful tools: depreciation, cost segregation, capital-gains planning, like-kind exchanges, and in some cases Opportunity Zones. When those pieces are sequenced correctly, your net taxable income from the portfolio can be reduced to zero or close to it.

The key is that the moves must be grounded in real economics and proper documentation. Aggressive games that ignore the substance of a transaction can create audit risk, penalties, and long-term damage. This episode focuses on strategies that are designed to survive scrutiny, not just look clever on a spreadsheet.

The biggest impact tends to show up for active investors, high-income professionals, and business owners whose real estate activity is more than just a side hobby. Once your tax bill consistently lands in the tens or hundreds of thousands, small deductions no longer move the needle — you need structure.

That said, even newer investors can benefit from starting with the right entities, agreements, and documentation. It is easier to build a clean system from the beginning than to unwind years of ad-hoc decisions later.

“Year-end cleanup” means you live your financial life first and ask tax questions later. You hand your CPA a pile of numbers and ask them to save as much as possible. They may find a few deductions, but the big decisions — entity choice, timing of acquisitions and sales, how money moved between companies — are already locked in.

Proactive design flips the order. You decide in advance how entities will relate, how cash will move, which elections you might make, and when to trigger gains or losses. Your CPA and attorney help you engineer the plan so that, when year-end arrives, the return largely reflects decisions you made on purpose, not accidents.

Holding companies and operating companies are tools for separating risk, organizing cash flow, and positioning income in a way that lines up with the Tax Code. A holding company might own interests in multiple projects, while operating entities handle management, construction, or brokerage work.

When inter-company agreements, fees, and distributions are drafted carefully, they can support your desired tax outcomes and protect assets at the same time. When they are sloppy or undocumented, they can create red flags for lenders, regulators, and the IRS. That is why this episode spends so much time on both structure and paperwork.

Online templates can be a starting point, but they cannot see your full risk picture or adapt when the law changes. In serious portfolios, the best results usually come from collaboration: the CPA handles elections, schedules, and returns, while the attorney focuses on contracts, entity formation, governance, and risk.

This episode is designed to help you understand where each professional’s leverage sits so you can ask better questions and avoid expecting one person to do work that properly belongs to the other.

The best time is before you feel boxed in. If you are consistently surprised by your tax bill, preparing to scale your portfolio, considering Opportunity Zone or complex partnership deals, or facing disputes around timing and documentation, it is time to bring a tax-aware real estate attorney into the conversation.

Early advice lets you design transactions correctly, rather than trying to fix them after the fact. Our team can work alongside your CPA and other advisors to align contracts, entities, and cash flow with the results you are actually targeting.

Tell us what notice you received or your next court date. We’ll confirm where you are in the process and recommend your strongest next move—without panic or guesswork.

We typically respond the same business day or the next business day.