Most owners don’t lose a tax appeal because their concern is unreasonable. They lose because the filing is late, the evidence is mismatched, or the case is presented in a way that is hard to verify.

If you treat your appeal like a short, organized proof file—what you want changed, why, and the documents that prove it—you put yourself in the best position to be taken seriously.

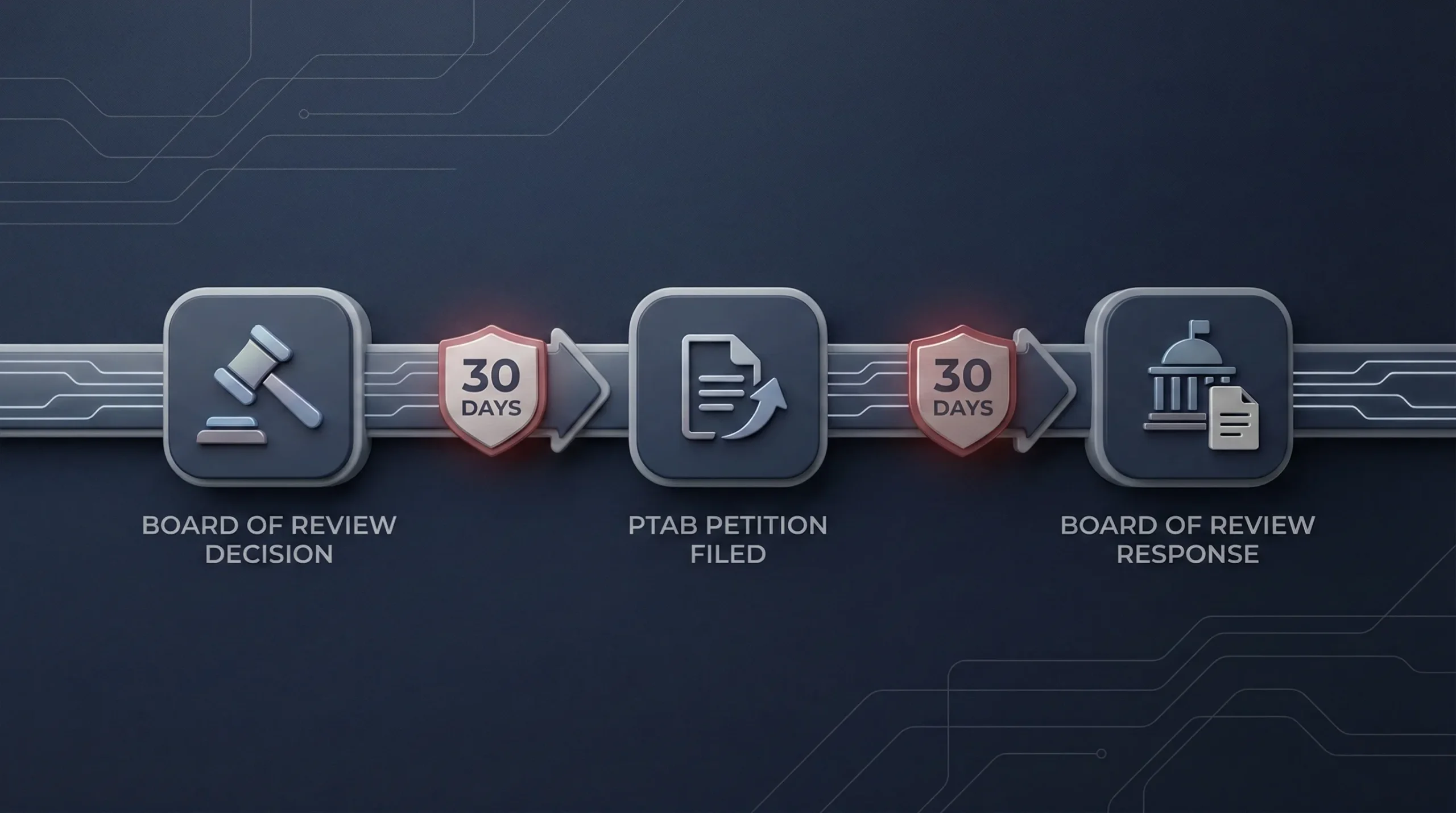

Two different deadlines to track:- Board of Review: Will County materials commonly describe a 30-calendar-day window from the date of notice to file with the Board of Review.

- PTAB: the PTAB filing window begins when Board of Review final decisions are mailed, and the deadline is 30 days from the notice date.

Below, we’ll walk through the practical steps: start with the notice and the Board of Review filing, then explain the PTAB “next level” process—what the Board of Review must submit, how dismissals and extensions work, and what you should do to keep your case clean and credible.

Confirm your deadline

Send your notice and township. We’ll confirm the correct clock and your best next step.

Step 1: Start With the Notice and the 30-Day Board of Review Window

Will County appeal guidance commonly frames the initial appeal as time-sensitive: you typically have 30 calendar days from the date of notice to file an appeal with the Will County Board of Review, and missing that deadline can forfeit the right to appeal for that year.

Before you file, pull together your base documents (notice, property facts, and your strongest evidence). If you wait until the last week, you usually end up filing a weaker case—or filing nothing at all.

Talk to Your Township Assessor (But Don’t Let It Burn the Clock)

Will County materials commonly recommend a quick conversation with the local township assessor because many issues can be clarified or corrected at the record level (square footage, characteristics, basic errors).

But: the filing period generally cannot be extended just because you are still discussing the assessment. So you want to do this early—while you still have time to prepare a clean appeal if the issue is not resolved.

Practical rule: Talk to the assessor early, document what you learn, and keep building your packet in parallel—so you don’t get trapped by the deadline.

This approach reduces panic filing. Even if the assessor conversation doesn’t solve the problem, it usually helps you pinpoint whether you are arguing record error, market value, or uniformity (comparables).

Step 2: Make Your Evidence Match Your Argument

The Board of Review (and PTAB later) is not deciding whether your tax bill feels high. It is evaluating whether your assessment is incorrect under the rules and evidence standards for that forum.

So the biggest quality upgrade is choosing the right “lane” and matching proof to it.

Common lanes and proof:- Record / factual error: documents and photos proving the record is wrong.

- Market value: recent comparable sales and/or a credible appraisal.

- Uniformity: comparable properties with similar characteristics showing your assessment is out of line.

- Income property: clean rent roll and operating reality (when relevant).

Keep it tight. A smaller packet with labeled exhibits and a simple explanation usually beats a large upload that forces the reviewer to hunt for the point.

Build a clean packet

We’ll organize comps and exhibits into a Board-friendly submission.

Step 3: If You Go to PTAB, Here’s What Actually Happens

Will County’s tax appeal page highlights a key transition point: the PTAB filing period begins when Board of Review final decisions are mailed, and the petition deadline is 30 days from the date of notice.

Once a PTAB petition is filed, PTAB rules control what the Board of Review must do next—especially the timing and contents of the Board’s response.

PTAB rule snapshot (Board of Review response): Upon notice of a PTAB filing, the Board of Review must submit its Board of Review Notes on Appeal disclosing the final assessment and reflecting any applicable local township multiplier, along with supporting evidence—generally within 30 days under the PTAB rules (unless there is a jurisdiction objection).

Dismissals, Jurisdiction Objections, and Extensions

PTAB procedure allows the Board of Review to challenge PTAB jurisdiction. If the Board objects to jurisdiction, it must submit a written request for dismissal before submitting the Notes on Appeal and supporting documentation. PTAB then transmits the motion to dismiss to the contesting party and typically secures a written response within 30 days of the motion’s postmark date, before issuing a jurisdiction decision.

If PTAB confirms jurisdiction and the Board of Review needs more time to submit evidence with the Notes on Appeal, the rules allow the Board to request an extension. PTAB procedure provides for a 30-day extension upon receipt of a request, with additional extensions possible for good cause.

Where to Get Forms (and Who to Call)

The Will County tax appeal page notes that appeal forms can be obtained by contacting the Will County Board of Review secretary at

(815) 740-4670.

If you’re unsure whether you are in the Board of Review stage or the PTAB stage, start by identifying what document you received:

- Notice of assessment / revision: typically points to the Board of Review filing window.

- Final decision notice: typically starts the PTAB clock if you are appealing further.

Do not mix the two clocks. Board of Review deadlines and PTAB deadlines are separate events, and confusing them is one of the easiest ways to lose the right to be heard.

If you want a fast reality check, we can review the notice you received, confirm which stage you are in, and tell you what evidence would actually help—before you spend time building the wrong packet.

Using Your Time Wisely Between Stages

If you’re moving from the Board of Review to PTAB, the most valuable thing you can do is clean up your record and exhibits. PTAB decisions are evidence-driven, and the process rewards clarity and completeness.

Use a simple structure:

- One-page explanation of your basis and requested conclusion.

- Exhibit list (A, B, C) with clean labels.

- Proof set that matches the basis (comps/appraisal/errors/income).

Quality control: If the reviewer can’t verify your best point in under a minute, your packet probably needs tightening.

This is also where counsel helps the most: not by “adding words,” but by organizing the case so it reads like a professional record—clean, verifiable, and deadline-compliant.

When It’s Smart to Get Help

Owners can file many appeals on their own. But when deadlines are close, values are high, or the evidence is complicated (income property, mixed-use, unusual features), the risk of a procedural mistake rises quickly.

Consider a review if:- You are within two weeks of a deadline

- You have limited comparable sales

- The property record appears wrong

- You are going to PTAB and need a clean record

A short review can prevent expensive mistakes: filing in the wrong stage, missing the right basis, or submitting evidence that doesn’t match the argument.

If you want us to help, our workflow is simple: confirm the correct stage and deadline, choose the cleanest argument, then package the exhibits so your submission is easy to verify and hard to ignore.

Talk it through fast

Call (312) 775-0980 for a quick strategy review before you file.

Frequently Asked Questions

Will County tax appeal process questions—answered in plain English. Educational only; not legal advice.

Written By: