Most Kane County appeals don’t fail because the owner’s concern is “wrong.” They fail because the filing is late, the documents are incomplete, or the evidence doesn’t match the argument.

If you treat your appeal like a short proof folder—what you want changed, why, and the documents that prove it—you immediately raise the quality of the submission (and your chances of being taken seriously).

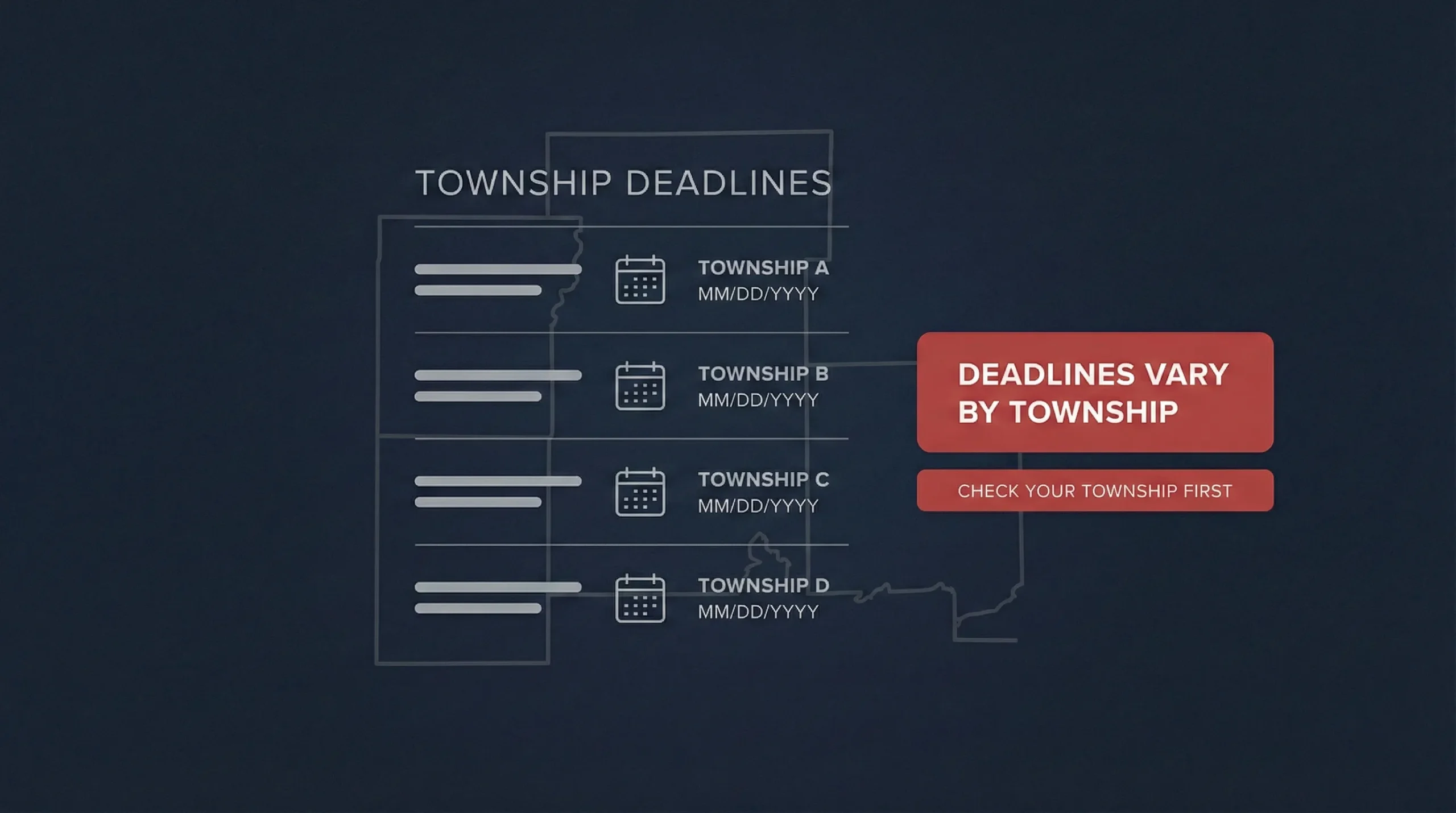

Important Kane County rule: Kane County publishes township-specific filing deadlines. Do not assume a universal county deadline.

Best practice: confirm your township deadline first, then build your evidence packet backward from that date.

Below is a clean, practical process: (1) verify your property facts, (2) confirm the correct township deadline, (3) build the strongest evidence set for your argument, (4) file through the Board of Review portal, and (5) understand next steps if you disagree with the outcome.

Confirm your deadline fast

Send your township and notice. We’ll confirm the Kane County filing cutoff and the best next step.

Step 1: Verify Your Property Facts Before You Argue Value

Start with the basics: your appeal is only as strong as the record it’s built on. If your property characteristics are wrong (size, features, classification), you can end up fighting the wrong battle.

Before you file, confirm:- Square footage and building features

- Basement/attic/garage details

- Classification/use (especially for mixed-use or nonstandard properties)

- Condition issues that materially affect market value

A Simple Way to Avoid Weak Appeals

If you’re claiming the assessment is too high, the reviewer will silently ask: “Compared to what?”

That’s why you want to lock down the property facts first—so your comparable properties are truly comparable and your argument doesn’t collapse on a basic mismatch.

Practical rule: If your appeal relies on a fact (size, condition, vacancy, use), have a document or photo that proves it—before you upload anything.

Once the record and facts are clear, you can choose the correct appeal lane: market value, uniformity (comparables), or record error (characteristics/classification).

Step 2: Kane County Deadlines Vary by Township

Kane County publishes a list of township deadlines for filing an assessment complaint. This means the smartest first move is not “gather comps”—it’s confirming the correct cutoff date for your township.

What to do today:- Confirm your township

- Confirm the published deadline for that township

- Calendar it with a buffer (don’t plan to file on the last day)

Why the buffer matters: last-minute filing often leads to sloppy comps, missing exhibits, and uploads that don’t match the chosen basis of appeal. The strongest cases look calm and organized—even when the owner is stressed.

Build a clean packet

We can organize comps and exhibits into a Board-friendly submission that is easy to verify.

Step 3: File Through the Kane County Board of Review Portal

Kane County provides an online Board of Review system where owners can register, submit complaints, and track filings. The filing method can feel simple—until you’re rushing under a deadline.

Goal: submit one clean, complete complaint that clearly states your request and includes the required evidence.

Submission checklist:- Choose one primary argument (value, uniformity, error)

- Write a short explanation of your request (2–6 sentences)

- Attach only the exhibits that support that request

- Label documents clearly (Exhibit A, B, C)

Step 4: Evidence That Actually Moves the Number

The strongest appeals are easy to verify. The weakest appeals are emotional, vague, or built on comps that aren’t truly similar.

Common evidence buckets:- Comparable sales (recent, similar, local)

- Comparable assessments (for uniformity arguments)

- Condition proof (dated photos + repair estimates/invoices)

- Recent sale documents (when truly arms-length)

- Record corrections (proof the property characteristics are wrong)

If your comps are weak, your appeal will feel weak—even if your conclusion is reasonable. Choose fewer comps if needed, but make them strong.

A Board-Friendly Packet Format (Fast and Effective)

If you want a simple structure that works, use this:

- One paragraph: what you’re appealing and what value/result you want

- One page: your best comparable summary (or grid)

- Exhibits: photos, estimates, sale docs, record corrections

Clean beats complicated. Reviewers should see your conclusion quickly and verify it in the exhibits without guessing.

If you’re not confident your comps are truly comparable, don’t guess—get a quick review first. A bad comp can do more damage than submitting fewer documents.

If You Lose: PTAB and Other Next Steps

If the county decision doesn’t reflect what your evidence supports, Illinois law provides additional appeal routes. One common next step is the Illinois Property Tax Appeal Board (PTAB), which has its own forms and requirements.

The practical takeaway is simple: if you think you may continue beyond the county, build your record carefully now. A clean record and clean exhibits matter more at the next level—not less.

Don’t waste your first filing. Even when you plan to keep appealing, the county record is the foundation. Build it like you might need it later.

If you want help deciding whether to continue, we can review the decision, compare it to your evidence, and tell you whether the next stage is worth the time and cost.

When It’s Smart to Get Help

Many homeowners can file on their own, especially for straightforward residential appeals. But complexity and deadlines change the risk.

Consider getting help if:- You’re inside two weeks of the township deadline

- The property is multi-unit, mixed-use, or commercial

- You have limited comparable sales

- The record appears inaccurate

- You may escalate to PTAB

Best use of counsel: not “more words,” but better structure—clean evidence, clean logic, and no deadline mistakes.

If you want a quick start, send your notice, your township, and any comps you’ve identified. We’ll tell you what’s strong, what’s missing, and what to do first.

Your goal isn’t to “fight taxes.” Your goal is to correct the inputs the system uses—using proof the reviewing body is allowed to adopt.

Talk it through quickly

Call (312) 775-0980 for a short strategy review before you file.

Frequently Asked Questions

Kane County tax appeal basics—deadlines, filing, and evidence—explained in plain English. Educational only; not legal advice.

Written By: