A DuPage assessment appeal is not a complaint about how high your tax bill feels. It is a focused attempt to show that the assessed value overstates market value or is higher than comparable properties.

When your appeal is built correctly, it reads like a simple proof file: what you want changed, why your number is more credible, and the documents that support it.

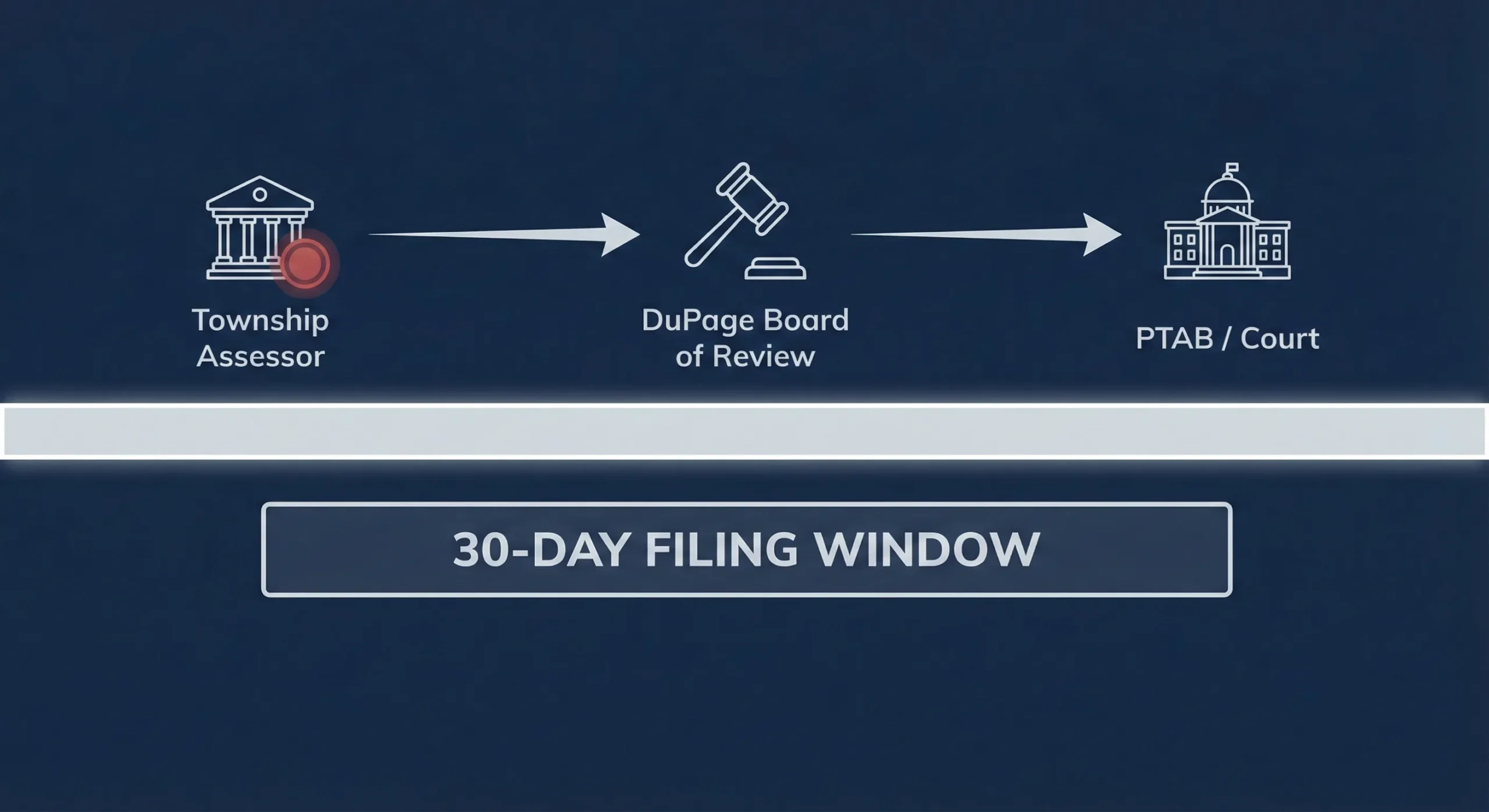

Deadline warning: DuPage’s appeal period generally ends 30 days after the publication of the township assessment roll. If you are even thinking about appealing, verify your township’s publication date and Board of Review deadline first.

Tip: Keep your evidence packet clean and readable—clarity beats volume.

Below, we’ll walk through the practical steps: (1) confirm your property characteristics, (2) select the right comparable properties, (3) build a tight evidence packet, and (4) understand what happens after you file—including decision timing and next-stage options if you disagree with the result.

Check your deadline fast

Send your township and assessment notice. We’ll confirm the filing window and the best next step.

Step 1: Verify Your Property Facts With the Township Assessor

Before you file anything, confirm the county record matches reality. DuPage guidance encourages owners to call or visit the Township Assessor first to review what is in the property file.

Why this matters: if the record shows the wrong square footage, features, or classification details, you might be paying based on a property you don’t actually own.

What to Check Before You File

Focus on the facts that drive value and comparability. If these are off, fix the record—or at least document the error—before submitting your appeal.

- Size: square footage, basement type, lot size

- Features: bedrooms/bathrooms, garage, additions

- Condition: deferred maintenance or functional obsolescence

- Use/class: whether the property is categorized correctly

Simple rule: If your appeal relies on a fact, you should be able to point to a document or photo that proves it.

Once you’re confident the record is accurate (or you can prove what is inaccurate), you’re ready to build the core of most DuPage appeals: comparable properties.

Step 2: Know Your Filing Window (DuPage’s 30-Day Clock)

DuPage property owners typically have a limited time to appeal after the township assessment roll is published. The county describes the period as ending 30 days after publication, and township publication dates vary—so you cannot assume your neighbor’s deadline is your deadline.

Do this first:- Find your township publication date

- Confirm the Board of Review deadline tied to that date

- Calendar it with a buffer (don’t plan to file on the last day)

If you miss the window, you may lose the easiest path for that year. Even when other options exist, missed deadlines usually mean more friction and fewer practical choices.

Build a stronger packet

We’ll help organize comps and evidence into a clean, Board-friendly submission.

Step 3: Build the Evidence the Board Actually Wants

DuPage guidance is direct: a property owner must provide evidence, and the evidence should include three (or more) comparable properties, preferably in the same neighborhood.

The key is matching the type of comps to the type of argument you’re making.

Choose the right comparables:- Market value appeal: use similar properties that sold recently

- Uniformity appeal: use similar properties with similar amenities and characteristics

Step 4: Understand Timing, Decisions, and “What Happens Next”

After you file, the DuPage process can feel slow—because the county conducts hearings and then issues written decisions after the county completes hearings. DuPage guidance notes decisions are typically mailed the following March, and not released before then.

If you disagree with the Board of Review decision, DuPage guidance describes further appeal options, including appealing to the Illinois Property Tax Appeal Board (PTAB) or to the Appellate/Circuit Court. The right next step depends on your facts, the record you built, and the deadlines that apply to the next stage.

Quick “Before You File” Checklist

Use this as your final quality check so you don’t submit a messy packet:

- Deadline confirmed: you know your township publication date and Board deadline

- Property facts reviewed: the record matches reality (or you have proof of errors)

- 3+ strong comps selected: truly similar and appropriate to your argument

- Best evidence included: appraisal, recent sale, or recent comparable sales (when available)

- Packet reads cleanly: short explanation + labeled exhibits + simple math

Board-friendly format wins. A reviewer should be able to understand your request in under 60 seconds, then verify it in the exhibits.

If you’re not sure whether your comps are actually comparable, don’t guess. Weak comps are one of the fastest ways to make a good case look unreliable.

Practical Notes DuPage Owners Miss

DuPage materials include a few reminders that help owners set realistic expectations and avoid bad arguments. These are not “law school” points—they’re the basic guardrails that keep your filing credible.

- Best evidence: recent appraisal, recent sale of the property, or recent sales of similar properties

- Sales window: assessed values are required to reflect prior years of actual sales transactions (DuPage guidance gives the example that a 2023 assessed value is based on 2020–2022 sales)

- Fair market value: not the highest or lowest price—more like the most probable selling price

- Similarity matters: use comparable properties with similar design and size

Translation: Your appeal should look like a reasonable valuation opinion supported by the market—not like a search for the lowest possible number.

If your argument is “my taxes went up,” the Board can’t act on that alone. If your argument is “my assessed value is overstated compared to these verified comparables,” the Board has something real to evaluate.

Why DuPage’s Process Has So Many Steps

DuPage property taxes run through two annual cycles: an assessment cycle (value-setting and review) and a levy cycle (local government funding). The assessment cycle involves the Township Assessors, the Supervisor of Assessments, the Board of Review, and the Illinois Department of Revenue’s equalization review.

Big picture:

Township Assessors enter values, the Supervisor of Assessments measures assessment level and may apply equalization, the Board of Review hears appeals and certifies the roll, and the Illinois Department of Revenue reviews for state equalization.

This is why a clean timeline matters. If you want a realistic result, you file during the correct window, with evidence that matches the type of challenge you’re making.

If you want help, we can do this in a practical way: confirm your deadline, identify the cleanest argument (market value vs. uniformity vs. errors), then package your best exhibits so the reviewer can verify your position quickly.

Not sure what to argue?

Market value vs. uniformity vs. errors—get a quick strategy call before you file.

Frequently Asked Questions

DuPage tax appeals, deadlines, and evidence—explained in plain English. Educational only; not legal advice.

Written By: