Most people assume the realtor, lender, or title company is “watching out for them.” In reality, each party has a different role—and none of them are paid to protect you legally the way your attorney is.

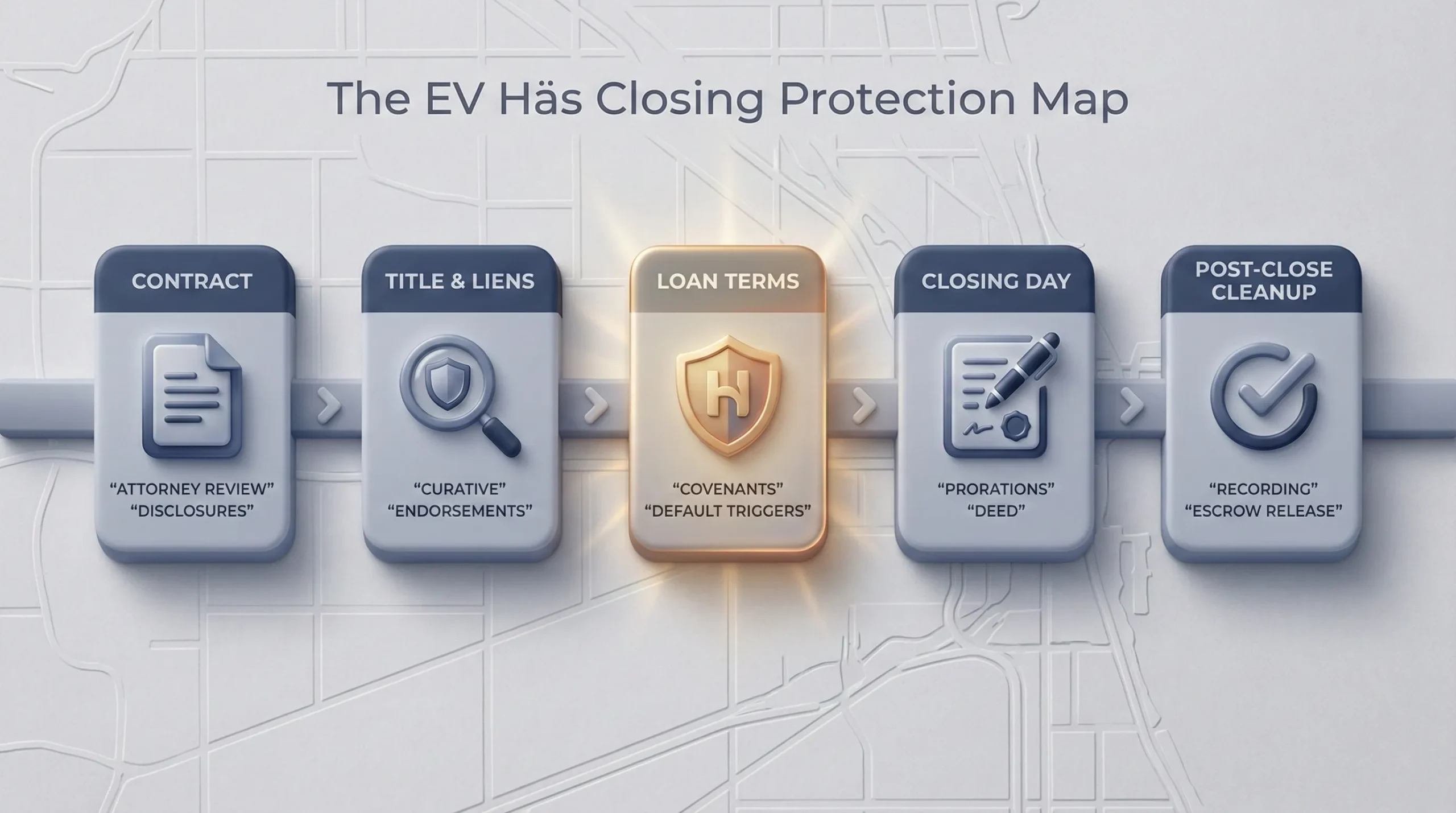

A real estate closing attorney is there to spot what others miss: one-sided contract language, risky loan covenants, title defects, surprise liens, unclear repair obligations, and “small” clauses that become very expensive after you sign.

Simple truth:

Closing a deal is technical. Protecting your interests is an art.

After you sign, it’s too late.

We combine real estate closing work with deep experience in foreclosure defense, corporate structuring, and building-code matters—so we can see both the transaction and the ways deals go wrong when something breaks.

Schedule a Free Consultation

Have a contract, title issue, or closing date coming up?

Call (312) 775-0980 to schedule a free consultation.

Why You Need a Real Estate Attorney at Closing

A realtor’s job is to help the deal close. A lender’s job is to get the loan funded. A title company’s job is to insure title based on its search.

Your attorney’s job is different: protect

you—legally and financially—before your signature becomes permanent.

We help by:- Explaining contract terms in plain English (so you actually understand the risk you’re accepting).

- Finding hidden problems: liens, permit issues, odd easements, unpaid judgments, and title defects.

- Negotiating repairs, credits, timelines, possession terms, and legal protections.

- Reviewing mortgage and closing documents to confirm they match what you agreed to.

What “Protection” Looks Like in Real Life

Protection isn’t vague. It’s concrete. It looks like catching the issues that create surprise bills and buyer’s remorse, such as:

- Unreleased liens and payoff mistakes

- “As-is” language that conflicts with disclosures

- Repair addendums that don’t actually require completion

- Loan covenants that trigger default even without missed payments

- Title exceptions that limit future resale or refinancing

Bottom line:

Without an attorney, you’re relying on the bank’s paperwork—and banks are not in the business of protecting you.

Want a plain-language guide for your clients or team? See:

Residential Closings

Buying or selling a home should feel exciting—not confusing. Our job is to make the transaction clean, documented, and defensible if anything is questioned later.

For Buyers, we typically:- Review and explain the purchase contract

- Coordinate title review and resolve red flags

- Review loan documents for mismatches or surprises

- Negotiate repairs, credits, and closing terms when needed

For Sellers, we typically:- Draft or review the purchase agreement

- Address title issues before they delay closing

- Prepare/coordinate deed and transfer documents

- Help ensure funds and payoffs are handled correctly

- Reduce post-sale liability and loose ends

If you’re selling under pressure (distress, arrears, looming litigation), the legal structure of your sale matters even more. That’s where our foreclosure-defense background becomes a real advantage.

Send Your Contract

Brokers and clients can send contracts for review so we can flag risk early and keep the deal moving.

1031 Exchanges

For investors, a 1031 exchange can be a powerful tool—but it’s also timeline-driven and paperwork-driven. If you miss deadlines, the tax deferral can fail.

Two major timing rules investors track:- 45 days to identify replacement property in writing (with specific requirements).

- 180 days to complete the exchange (or the tax return due date with extensions, if earlier).

Investor mindset:

Don’t treat 1031 like a “closing add-on.” Treat it like a project plan—with dates, documents, and a defined execution team.

Commercial Real Estate Closings

Commercial deals carry bigger upside—and bigger legal risk. The documents are usually longer, the defaults are often more technical, and the lender protections are stronger.

We help commercial buyers and investors by:- Identifying harsh loan terms and negotiating changes

- Flagging covenants that can trigger default without a missed payment

- Reviewing guarantees, entity obligations, and closing conditions

- Structuring solutions when the bank won’t budge

If you’ve ever looked at a commercial loan package and thought, “This feels one-sided,” you’re not imagining it. Our role is to push back—before you sign yourself into a trap.

Where Commercial Deals Usually Break

Commercial deals rarely break because someone forgot to sign a page. They break because of preventable legal friction, such as:

- Title issues that surface late

- Environmental or building-code risk that changes lender terms

- Tenant/lease problems that change valuation or underwriting

- Loan conditions that can’t realistically be satisfied on time

Practical takeaway:

Commercial closings are not just closings—they’re risk management projects.

If you need help structuring the ownership side of a deal, we can also coordinate entity and liability considerations so the “paper” matches the real-world plan.

Brokers don’t need an attorney who slows the deal down. They need an attorney who protects the client without creating chaos.

We work alongside brokers to keep closings smooth while resolving legal issues that can derail a transaction at the last minute—title defects, liens, permit problems, and risky contract language.

If you want client-friendly language and sharper deal positioning, see:

Brokers:

Send contracts directly to closings@evlawgroup.com so we can review quickly and keep your timeline intact.

Contact EV Häs, LLC

Whether you’re buying, selling, investing, or navigating a complicated closing, we’ll help you move forward with clarity—and with stronger legal protection than “standard paperwork” provides.

Call: (312) 775-0980

Email: clients@evlawgroup.com

Counties served:

Cook, DeKalb, DuPage, Kane, Kendall, Lake, McHenry, and Will County.

If you have a draft contract, title commitment, or loan package, send it over and we’ll help you identify the real risk before you sign.

Investor Closings

Buying multi-unit or commercial property?

We negotiate documents so you’re not locking yourself into lender-friendly terms.

Frequently Asked Questions

Quick answers about real estate closings and legal protection in Illinois.

Written By: