If you’re behind on payments and trying to work something out, you might assume the foreclosure case “pauses” while your servicer reviews a modification or repayment plan. In real life, Illinois homeowners often learn the hard way that the lawsuit can keep moving even while the servicer says your application is “in progress.”

That collision is commonly called dual tracking: two tracks running at the same time—negotiation on one side, foreclosure pressure on the other.

Plain-English risk: If the court schedule advances while you’re focused on the servicer, you can miss response deadlines, hearing dates, or motion deadlines—then lose leverage you didn’t realize you had.

This article explains what dual tracking looks like in real life, what to save and track immediately, and how an Illinois foreclosure defense strategy can work alongside mortgage litigation when a servicer’s conduct or records don’t match what they’re telling you.

Quick Case Review

Send your most recent court notice and your most recent servicer message (portal screenshot, email, or letter). If you have a court date or sale date, include it.

Call (312) 775-0980 or request a free case analysis.

What “dual tracking” means (without legal jargon)

Dual tracking is not a vibe—it’s a pattern.

Track 1: Your servicer is talking about a modification, repayment plan, forbearance exit, or “loss mitigation review.”

Track 2: The foreclosure lawsuit continues in Cook County (or another Illinois county): appearances, motions, orders, and eventually steps toward judgment and sale.

The homeowner gets stuck between two systems that don’t automatically sync. One side speaks in “we’re reviewing,” the other side speaks in deadlines.

What dual tracking looks like in real life

Here are common Illinois scenarios that should raise your antenna immediately:

- You’re submitting documents repeatedly, but the servicer keeps claiming items are “missing.”

- You receive a denial letter that doesn’t match what you submitted (or ignores income documents you can prove were uploaded).

- You’re told the file is “escalated,” but your attorney receives a new motion or a hearing date is set anyway.

- You’re negotiating terms, yet the plaintiff’s counsel pushes for default, judgment, or sale scheduling.

- You get two conflicting messages at once: “application received” and “you are in foreclosure” with a new court notice.

Key idea: The court process and the servicer process run on different clocks. If you don’t track both, the faster clock wins.

Dual tracking matters because your options often depend on what you can prove: what you sent, when you sent it, what the servicer said, and what the court scheduled next. Documentation turns confusion into a timeline—and timelines create leverage.

Why this matters in Illinois foreclosure cases

In Illinois, foreclosure is a lawsuit. Once it’s filed, you’re dealing with court procedures, deadlines, and motion practice—not just customer service conversations.

That’s why dual tracking is so dangerous: a homeowner can spend weeks chasing a “complete package” while the case advances toward default, judgment, or a sale track. Even when a resolution is possible, poor coordination can shrink the set of realistic outcomes.

What you’re protecting:- Deadlines: response deadlines, appearances, motion deadlines, and court-ordered dates.

- Leverage: the ability to negotiate from a position of strength instead of panic.

- Options: modification paths, settlement paths, sale planning, or defense strategy—depending on facts and timing.

If you’re in Chicago or Cook County, the volume of foreclosure cases means calendars can move quickly once certain steps happen. The safest mindset is: the case is moving unless you have proof it isn’t.

Servicer Says “In Review” But Court Is Moving?

That mismatch is the moment to get organized and protect deadlines. A clean timeline can change the conversation fast.

What to document immediately (your evidence-first checklist)

If dual tracking is happening, your best move is to build a clean, date-stamped record. Not a messy screenshot pile—an organized timeline.

Save these items (with dates):- Court documents: summons/complaint, notices, motions, orders, and any sale-related notices.

- Servicer communications: portal messages, emails, letters, denial notices, “missing documents” notices.

- Upload proof: confirmation screens, submission IDs, fax confirmations, certified mail receipts.

- Payment history: statements, transaction history, escrow changes, suspense account notices.

- Loss mitigation package: what you actually submitted (PDF copies), not just what you remember.

- Your timeline: a simple list of events (job change, hardship, forbearance end, modification attempts).

How EV Häs approaches dual tracking cases

Dual tracking problems sit at the intersection of foreclosure defense and mortgage litigation. That intersection is exactly where EV Häs works: court deadlines, document strategy, and communication proof—coordinated so you don’t lose options while you’re trying to solve the problem.

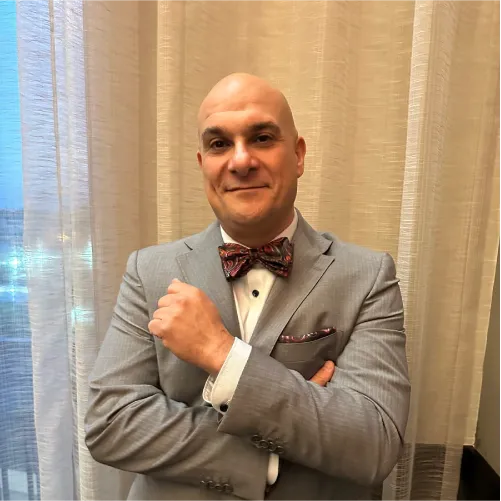

Mahmoud Faisal Elkhatib focuses on calm, plain-English strategy: what the documents actually say, what the timeline is doing, and what decisions matter next. Damon Ritenhouse brings an evidence-first litigation mindset to mortgage disputes: when records don’t match statements, when servicing conduct doesn’t match promises, and when the paper trail is the whole case.

Together, the goal is not drama. The goal is control: confirm the posture of the lawsuit, preserve deadlines, and use documentation to push the matter toward a realistic outcome.

The strategy that prevents “silent” losses

When homeowners lose leverage, it’s often not because they “did nothing”—it’s because they did a lot, but in the wrong arena. You can upload documents for weeks and still lose time in court if the case moves forward without a coordinated response.

A practical approach:- Confirm the court posture: what is pending, what is due, what is scheduled.

- Build the timeline: what you sent and what the servicer said, with proof.

- Choose your lane: negotiation, defense, sale planning, or dispute escalation—based on facts and time left.

This is how you stop the case from drifting into avoidable default outcomes while still pursuing the resolution you’re trying to achieve.

If you’re negotiating and getting foreclosure notices, do this today

If you suspect dual tracking, your first win is simple: get organized, get your dates straight, and stop relying on verbal updates that can’t be proven later.

3 things to gather before you call:- Your latest court notice: anything with a hearing date, order, or motion.

- Your latest servicer update: portal message, letter, or denial notice.

- Your submission proof: confirmation IDs, screenshots, certified mail receipts, or fax logs.

Call (312) 775-0980 or request a free case analysis.

If you have a court date or sale date, mention it first.

A fast review usually answers three questions: What stage am I in? What deadline controls my next step? What are my realistic options from here?

The bottom line

Dual tracking thrives on confusion. The fix is not panic—it’s a timeline, a document set, and a plan that respects the court schedule while you negotiate (or challenge) the servicer’s handling of the file.

If you’re feeling whiplash, you’re not imagining it.

When the messages don’t match the notices, treat that mismatch as time-sensitive—because deadlines don’t wait for portal updates.

Disclaimer: This page is for informational purposes only and does not create an attorney-client relationship. It is not legal advice. Results vary based on facts, documents, timing, and court procedures.

Next step: Bring the most recent court document you received and the most recent servicer communication you received. If you’re not sure what matters, start with the newest notice—it usually tells you what the system is about to do next.

Sale Date or Motion Pending?

If your case is accelerating, time matters. Start with documents and dates, not assumptions.

Dual Tracking FAQ (Illinois)

Search-style questions with plain-English answers (general information only).

Written By: