Most real-estate deals don’t fall apart because the buyer changes their mind. They fall apart because something small was missed — and then it becomes expensive.

Being your client’s advocate means you’re not just pushing the file forward. You’re helping them avoid the kind of surprise that turns an exciting closing into a financial or legal mess.

Advocacy = prevention.

When your attorney is proactive, you’re not “explaining problems” to your clients — you’re explaining options.

At EV Häs, we work with brokers who want an attorney partner that communicates clearly, moves with urgency, and knows how Chicago transactions really work — from municipal compliance to title and closing-cost strategy.

Need a Reliable Closing Partner?

Send the address + timeline and we’ll confirm the next steps, flag obvious risks, and help you set your client’s expectations early.

What Your Clients Need From Their Attorney

Your client usually thinks an attorney is only there to “do paperwork.” In real life, the attorney’s job is to

prevent the transaction from becoming a lawsuit — and to protect the client if the deal starts drifting toward conflict.

A strong closing attorney helps your client:- Understand what they’re signing (and what it actually means)

- Catch risks hiding inside the record, the municipality, or the property’s history

- Negotiate solutions without escalating drama

- Stay compliant with timelines and local requirements

- Close with fewer surprises and cleaner documentation

How to Advocate for Your Clients

If you want to advocate like a pro, think of every deal as two tracks running at the same time: the emotional track (your client’s excitement or fear) and the technical track (documents, deadlines, compliance, money).

Your job is to keep the emotional track steady while the attorney keeps the technical track clean — and those two roles work best when they’re coordinated early, not at the finish line.

Broker + Attorney = calmer clients.

When you introduce legal support early, clients stop guessing, stop spiraling, and start making decisions with real information.

In practice, that means you loop in your attorney before small issues turn into “big problems,” especially when you notice red flags like rushed timelines, unusual title notes, unclear repairs, or a seller history that doesn’t fully add up.

Silent Deal Killers: Protect Your Buyer

Many buyer disasters aren’t dramatic — they’re quiet. The buyer closes, moves in, and then learns the property has a problem nobody prepared them for.

Common silent deal killers include:- Code violations (existing citations, inspection history, unresolved city issues)

- Past construction without permits (finished basement, electrical, plumbing, additions)

- Municipal or utility issues (certain balances, compliance requirements, documentation gaps)

- Title-related surprises that delay closing or force last-minute negotiations

Buyer protection mindset:

“Assume something exists until we confirm it doesn’t.”

That’s why we help coordinate smart diligence — including targeted requests and, when appropriate, FOIA-driven information gathering — so the client doesn’t learn the truth after closing.

When problems show up early, you still have leverage. We can often turn a “deal threat” into a structured choice: negotiate credits, require repairs, extend dates properly, or walk away with clarity instead of regret.

Want to Lower Buyer Closing Costs?

Ask us whether bifurcated title fits your deal. When it does, it can reduce certain title-related fees without changing the legal protections your buyer needs.

Silent Deal Killers: Protect Your Seller

Seller-side risk is different. The danger is rarely “the seller didn’t know.” The danger is that something was known (or should have been known) and wasn’t handled cleanly — and now the seller is exposed after closing.

Your seller needs an attorney who can separate buyer diligence from seller disclosure, and help present the file in a way that is accurate, defensible, and not unnecessarily alarming.

Clean seller strategy:

Disclose what must be disclosed, document what’s been done, and avoid casual statements that create confusion later.

Goal: fewer renegotiations, fewer accusations, fewer post-closing headaches.

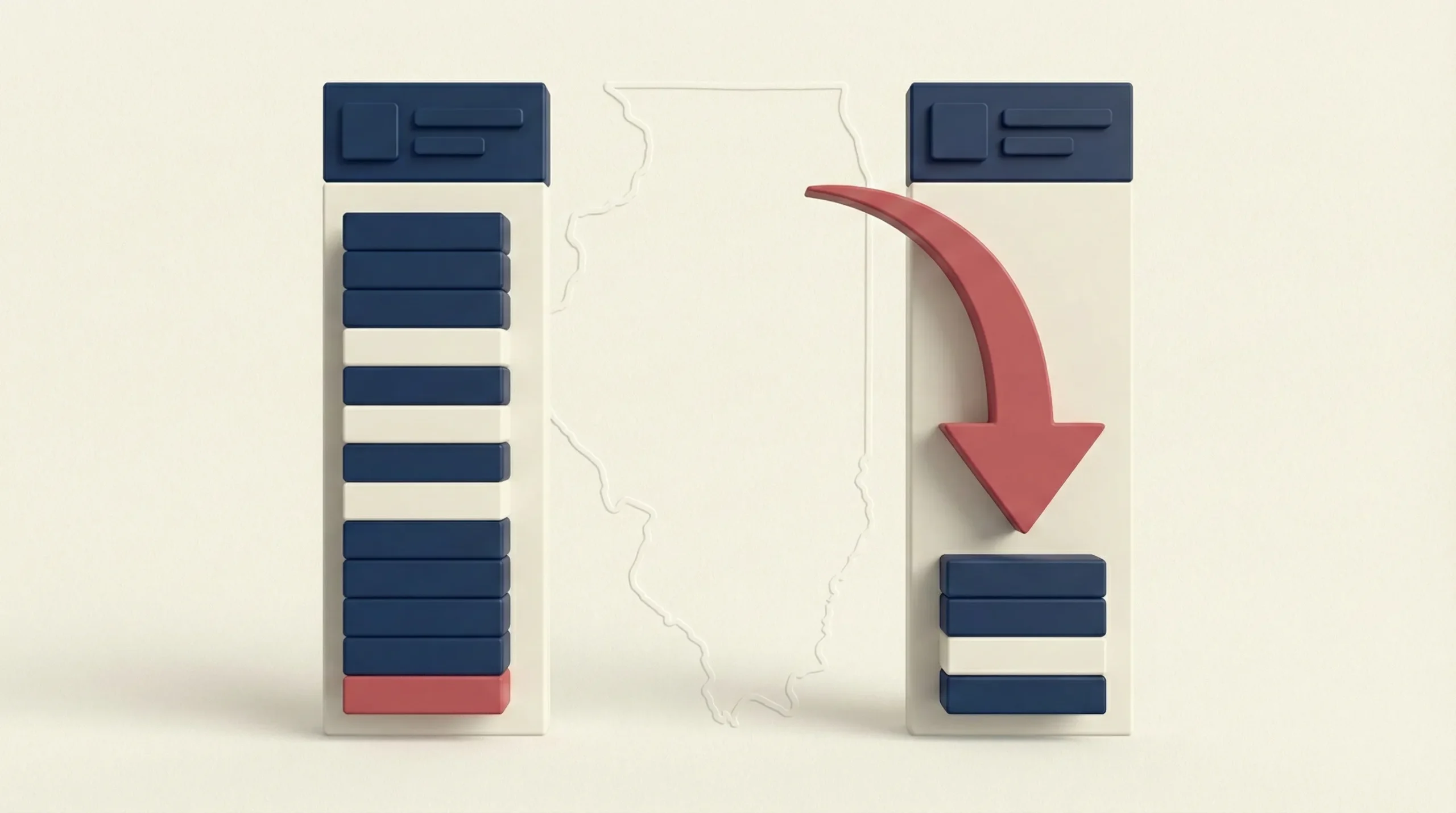

Bifurcated Title: A Simple Way to Cut Closing Costs

In many Illinois transactions, the buyer can reduce certain title-related costs by using a strategy called bifurcated title.

Plain English: the buyer’s attorney can coordinate the legal closing while the buyer chooses a separate title provider for the buyer’s title insurance policy — often resulting in meaningful savings depending on the deal structure.

This isn’t a gimmick. It’s a cost strategy — and like any strategy, it works best when it’s explained clearly and coordinated professionally.

We treat it like we treat every tool: we use it when it helps the client, we explain it in plain language, and we make sure the process stays smooth for everyone at the table.

Bifurcation Myths (and How We Handle Them)

Myth #1: “Bifurcation is shady.”

Reality: It’s a pricing and provider-choice approach — not a change to the buyer’s legal protections when coordinated correctly.

Myth #2: “It will slow down the deal.”

Reality: Delays usually come from confusion, not the strategy itself. We prevent that by explaining the workflow early and keeping communication tight.

Myth #3: “The seller’s side won’t accept it.”

Reality: Pushback often disappears when the process is presented calmly, professionally, and early — with the right documentation.

Broker tip:

Position bifurcation as a cost comparison, not as “switching teams.” When everyone hears it as a savings tool (not a threat), the temperature drops immediately.

If the other side raises concerns, we handle it directly with the attorneys and title contacts — so you’re not stuck trying to “sell” the concept in the middle of an already tense negotiation.

What You Want From Your Attorney on Every Deal

On buyer deals:- Early red-flag review (title notes, municipal risk signals, documentation gaps)

- Clear explanation of obligations and deadlines

- Fast response when the deal shifts (inspection issues, credits, extensions)

- Closing cost strategy when appropriate (including bifurcation analysis)

On seller deals:- Disclosure guidance that protects the seller without creating unnecessary fear

- Document organization and clean contract compliance

- Firm, professional negotiation posture when buyer demands escalate

- A closing that’s documented cleanly for post-sale peace

Our communication standard:

We keep the client informed in plain language, and we keep the broker informed at the level you need to manage expectations — without dumping legal chaos on your day.

When the deal goes sideways, your client needs calm clarity — not confusion. That’s where strong counsel makes you look like the steady professional you are, because the client sees a team that knows what it’s doing.

How to Refer Clients to EV Häs

Referring a client should feel simple. The best referrals happen when we get involved early — before deadlines start compressing and options start shrinking.

You can refer a client when:- They need a closing attorney and want clear guidance

- You spot red flags (permits, city issues, title questions, unusual seller history)

- They want to explore bifurcated title as a cost-saving move

Referral checklist:

Property address + target closing date + the client’s role (buyer/seller) + any concerns you already see.

Once we have the basics, we’ll take it from there: intake, timeline review, and a clear next-step plan that makes your client feel supported immediately.

And yes — we know referrals reflect on you. We treat your client the way you would: respectfully, clearly, and with the urgency the transaction deserves.

Referring a Client?

We make your referral look good: clear intake, fast follow-up, and plain-language communication so your client feels guided — not confused.

Frequently Asked Questions

Quick answers for brokers and agents who want to protect clients, reduce surprises, and close cleanly in Chicago-area deals.

Written By: